In my last blog, I talked about the issue that Michigan has been spending much less on roads than the rest of the nation for decades and that we were far behind what many of the other Great Lakes states were spending. This blog focuses on how Michigan is similar or different from other states in how we fund roads.

Gas taxes

When the legislature was debating transportation funding in 2015, many people pointed to national studies that showed Michigan having some of the highest taxes on gasoline in the nation. Others pointed out that Michigan had one of the lowest gasoline taxes in the nation. So who was right? Both! In 2016, Michigan’s gasoline tax was 19 cents per gallon. Only 10 states had a gas tax lower than Michigan’s at that time and only four of those states had a tax below 17 cents a gallon.

What clouded the debate was the fact that Michigan is one of the few states that levies a sales tax on gasoline. This created one of the highest overall tax rates on gasoline in the nation. However, none of the sales-tax revenue, with minor exception, goes to road improvements. The state’s constitution directs nearly 75 percent of the sales-tax revenues to the school-aid fund and another 10 percent to municipalities in the form of revenue sharing. The rest is part of the state’s General Fund. It should be noted that Indiana just subjected gasoline sales to their sales taxes, but they dedicated those new revenues to fixing their roads.

So where is Michigan today? Right in the middle of the pack. Michigan’s current gas tax is 26.3 cents per gallon. That places Michigan 22nd in the nation. Three other states are just behind Michigan charging 26 cents per gallon. You can’t get much closer to the middle than that.

Vehicle registration fees

The second largest source of revenue for Michigan’s roads comes from vehicle registration fees. This year, approximately $1.3 billion will be collected from the vehicle owners of the state. Actually, there are several different types of taxes on vehicles depending on who owns the vehicle and how it is used. Generally, passenger vehicles pay a vehicle registration fee of 0.6 percent of the list price of the vehicle. This is a 20 percent increase over the amount paid prior to 2017. Commercial haulers pay a registration fee based on the load capacity of the vehicle. There are other methods of taxation for commercial, electric, and hybrid vehicles. The per-capita revenues derived from registration fees place Michigan in the top tier of states in amount collected from this revenue.

Did federal funding contribute to Michigan’s problems?

Michigan is often described as a donor state in relation to the amount it receives from the federal gasoline tax. While this was true in the past, currently every state receives more money from the federal transportation fund than it pays in federal fuel taxes. In 2013, Michigan received almost 14 percent more, or an additional $125 million. This still places Michigan near the bottom on return of taxes collected. Currently, the Federal Highway Trust Fund is distributing about 25 percent more than it collects each year, with the difference coming from the overall federal budget.

While a lack of federal funding has hurt Michigan over the years, a change in distribution policy is unlikely to significantly impact the state’s situation. If Michigan were to see an increased share of the federal highway fund, to the point where Michigan was getting “its fair share,” Michigan would see an additional $100 million per year. While that amount would be helpful, by itself it would not have anything more than a marginal impact on our state’s roads.

Michigan: Why do we have average revenues and bottom-of-the-barrel spending?

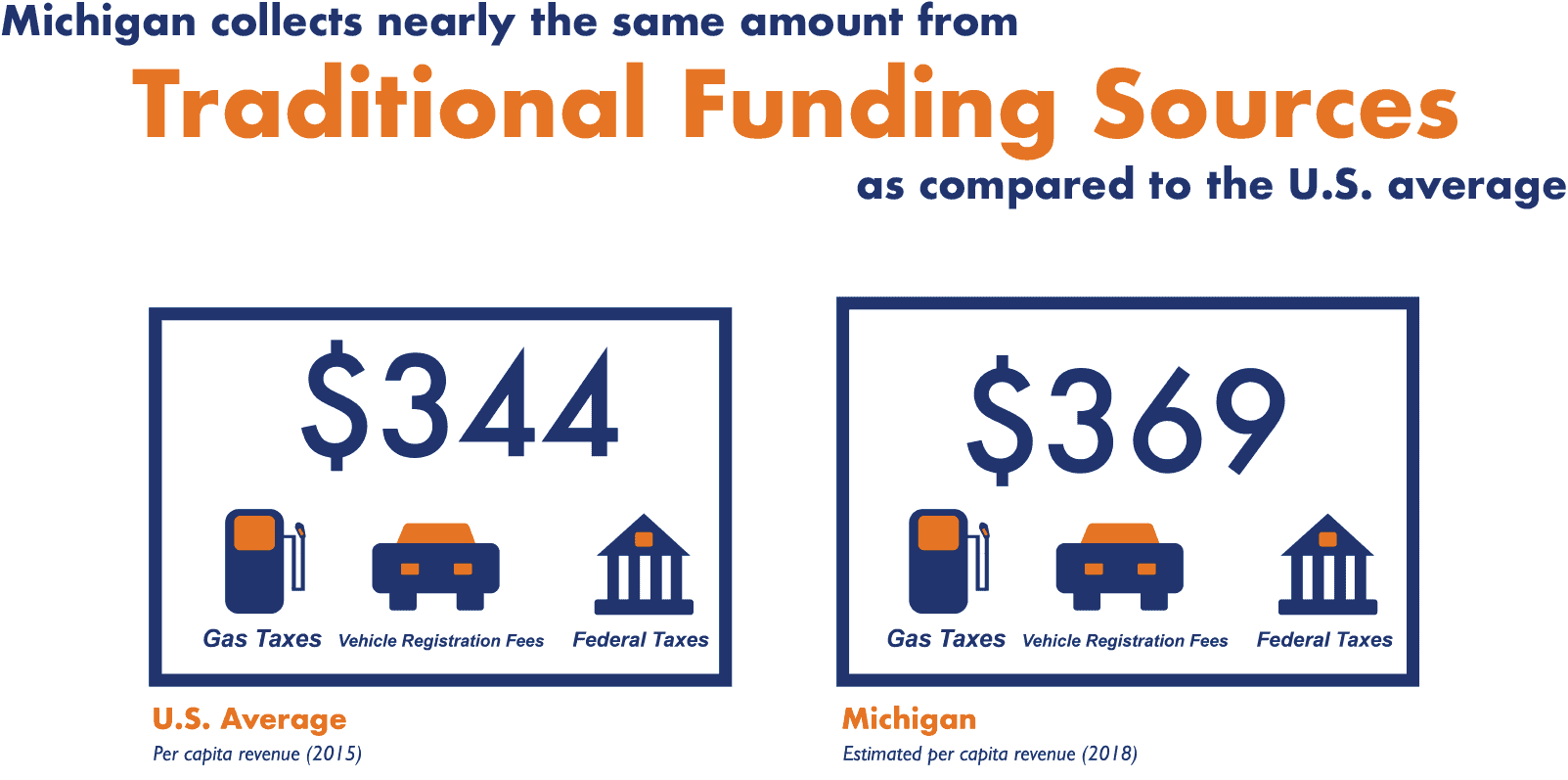

When looking at the three primary user fees (federal and state gas taxes and vehicle registration fees) used to fund road construction and maintenance, Michigan is now collecting a fairly average amount per capita compared to the rest of the nation, but in the last blog it was pointed out that Michigan is still spending much less than the national average on its roads. How does this happen?

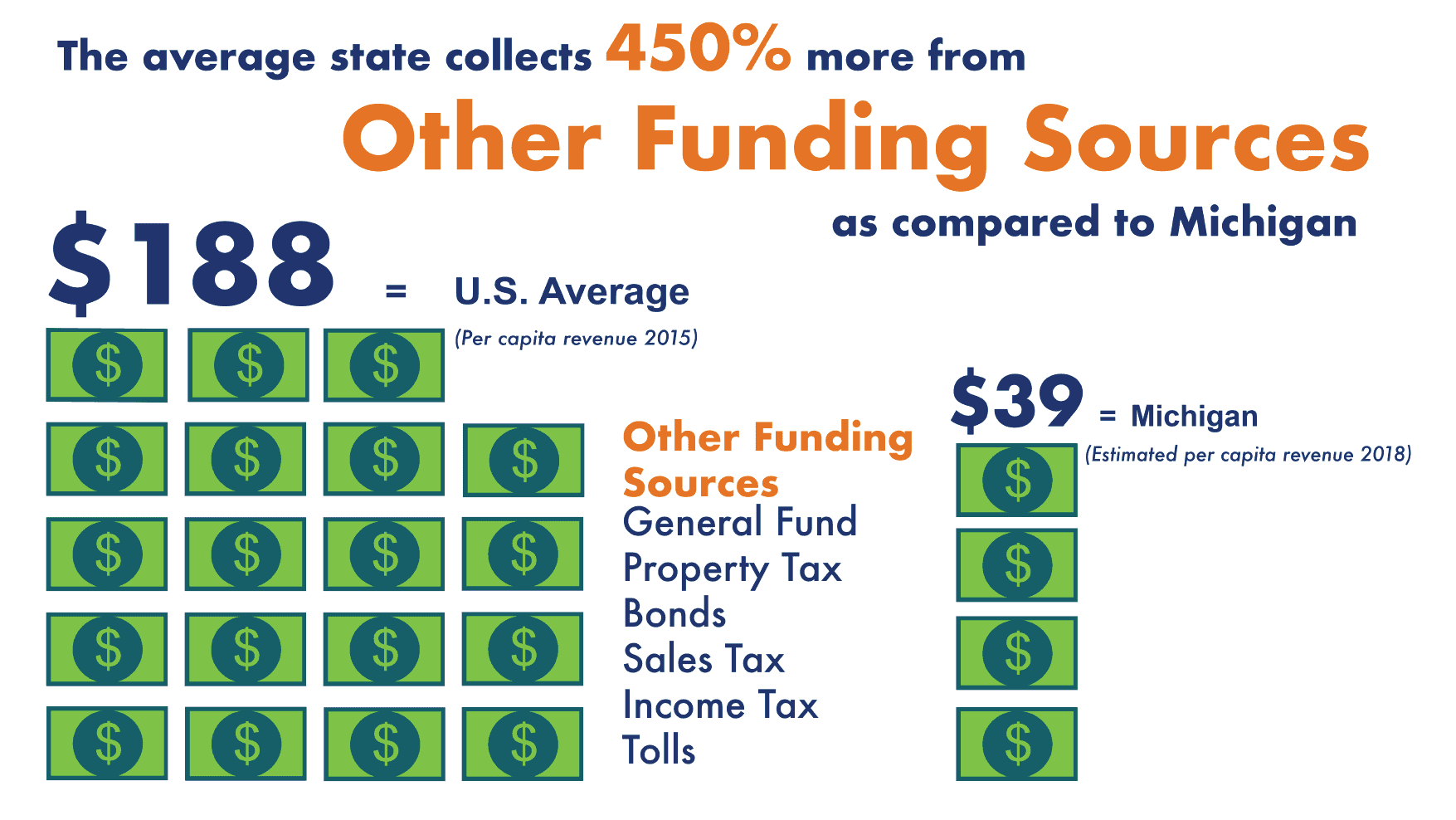

This inconsistency is better understood when one other factor is taken into consideration: our nation no longer relies exclusively on user fees to pay for roads. As a nation, for every dollar of gas tax or registration fees used to operate the road system, another dollar from property taxes, sales taxes, income taxes, tolls, or other general-fund revenue is also spent. Nationally, we use nearly as much non-user-fee revenue to run our road systems as we do user fees.

Over the decades Michigan has never broken from its pattern of strict reliance on the three basic sources of road funding – fuel taxes, registration fees, and federal funds. Issues such as gas-tax rates and vehicle registration fees are tracked by numerous national entities. When road funding debates developed, Michigan would check itself against the rates in other states, and finding them comparable, would conclude that Michigan was spending the same on roads as everyone else. In fact, it is the other sources of revenue that are used for roads – rarely documented – that push other states well ahead of Michigan.

Michigan’s state government has traditionally avoided funding roads with anything except user-fee revenues. They have bonded from time to time, but those bonds were repaid with user-fee revenues. The state finally broke this pattern in 2012 when it appropriated some general funds to the transportation budget. Eventually, the annual appropriation reached $400 million in the FY 2016 state budget, representing approximately 15 percent of revenues coming from the state for transportation purposes.

However, the general fund revenue was removed from the state transportation budget in FY 2017, when the new fuel tax and registration fee revenues began to be collected. The state is required to phase in $600 million in general-fund support over the next few years, but Michigan will still be extremely dependent on user fees as compared to other states.

Has Michigan corrected its course on roads?

The years of inadequate funding for roads will have a large impact on Michigan’s road system years into the future. In 2007, 25 percent of the federal-aid-eligible roads (highways and other major roads) were evaluated to be in poor condition, meaning that they were in need of complete reconstruction; by 2017, the percentage had jumped to 40 percent.

The Governor’s Infrastructure Task Force concluded that Michigan needed to increase its spending on roads by $2.7 billion per year. SEMCOG has calculated that we need to spend an additional $1.2 billion per year for the next 25 years to get major roads back to 80 percent good or fair condition in our seven-county region. We will need an additional $1.4 billion per year to get them back to 90 percent in good or fair condition, which is the preferred objective.

Michigan has been underfunding its road system for many years. It will take a concerted effort for many more years to get roads back to an acceptable level. There are no magic answers. It simply means understanding the reality of the situation and mixing it with determination to fix the problem.

Leave a Reply