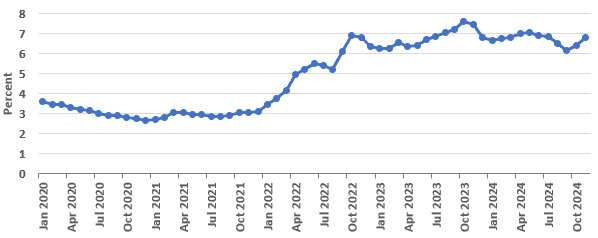

2024 was a banner year for the region’s taxable value growth. Overall, taxable value grew by 7.8% and was led by residential property which grew by 8.2% (Figure 1). The growth reflected the rapidly rising housing values since 2020.

Figure 1

Annual Percent Change in Taxable Value (Real Property)

Southeast Michigan

Source: SEMCOG analysis of Michigan State Tax Commission data

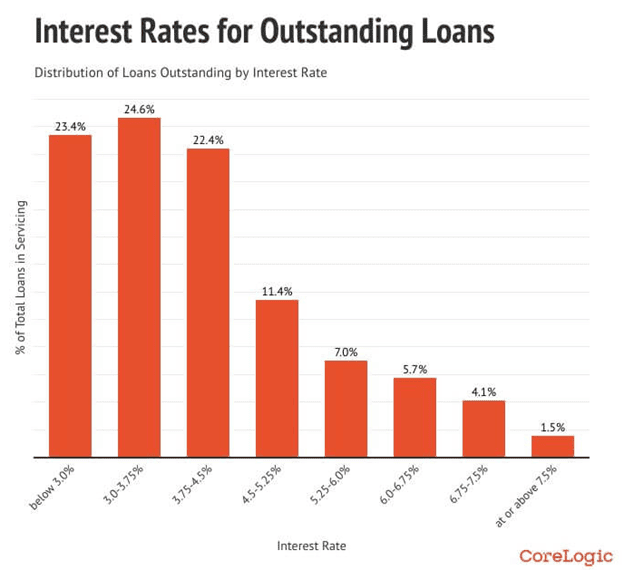

With housing prices rising by roughly 40% since 2019, home affordability is a major issue. So what can be done? Economics 101 instructs that when prices for a good like housing increase, that signals to producers to increase supply – in this case more housing – because higher prices will generate greater profits. However, that has not been happening. Figure 2 shows the trailing 12-month building permits for Southeast Michigan and, total building permits, after spiking in 2021, leveled-off in 2022 and 2023, and declined in the first half of this year.

Figure 2

Trailing 12-Month Building Permits

Southeast Michigan

Source: SEMCOG.

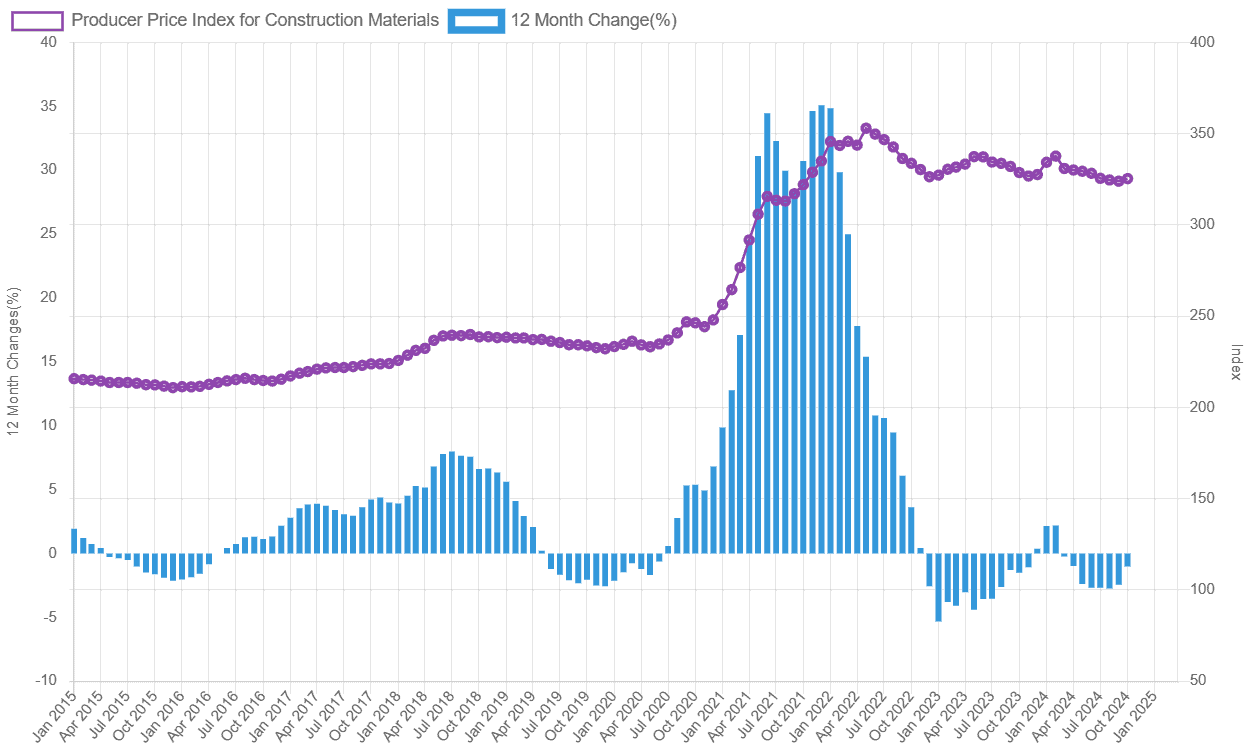

So why has home building slowed? It looks like there are multiple reasons. First, the cost of construction materials skyrocketed during the pandemic. As Figure 3 shows, the wholesale cost of construction materials went up no more than 8 percent in any given 12-month period between 2015 to 2021. However, between February 2021 to July 2022, construction materials increased by double-digit percentage points from a year earlier, ranging from 10% to 35%.

Figure 3

Producer Price Index for Construction Materials

United States

Source: U.S. Bureau of Labor Statistics, Producer Price Index by Commodity: Special Indexes: Construction Materials [PPIFIS], retrieved from FRED, Federal Reserve Bank of St. Louis.

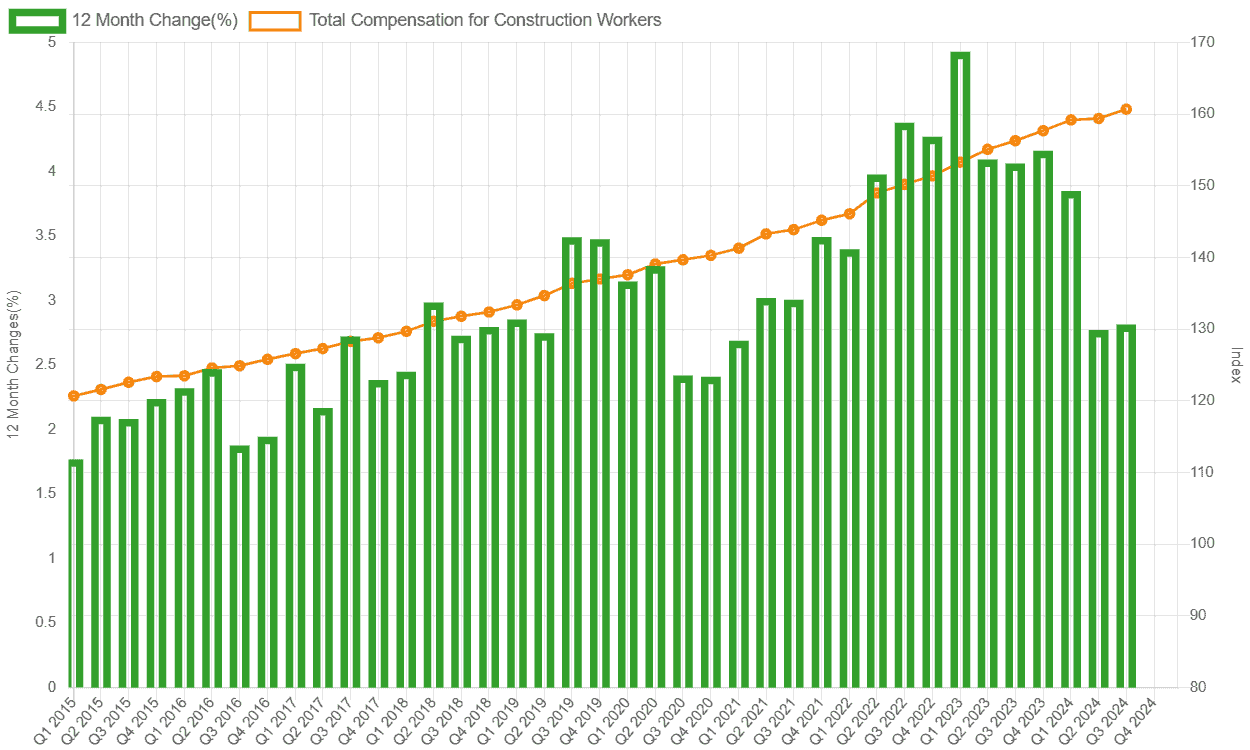

Second, compensation for construction workers increased at an annual rate between 4% to 5% between the second quarter 2022 and fourth quarter 2023 (Figure 4). While not as dramatic as construction material costs, higher labor costs likely put a dent in new construction.

Figure 4

Total Compensation for Construction Workers

United States

Source: U.S. Bureau of Labor Statistics, Employment Cost Index: Total compensation for Private industry workers in Construction, retrieved from FRED, Federal Reserve Bank of St. Louis.

The increased compensation can be tied to the ongoing labor shortage experienced by the home building industry. The National Association of Homebuilders found in their February 2024 Housing Market Index (HMI) survey, that while the labor shortage has eased, it is still elevated compared to historical patterns. Certain trades like carpenters and bricklayers/masons have more serious shortages.

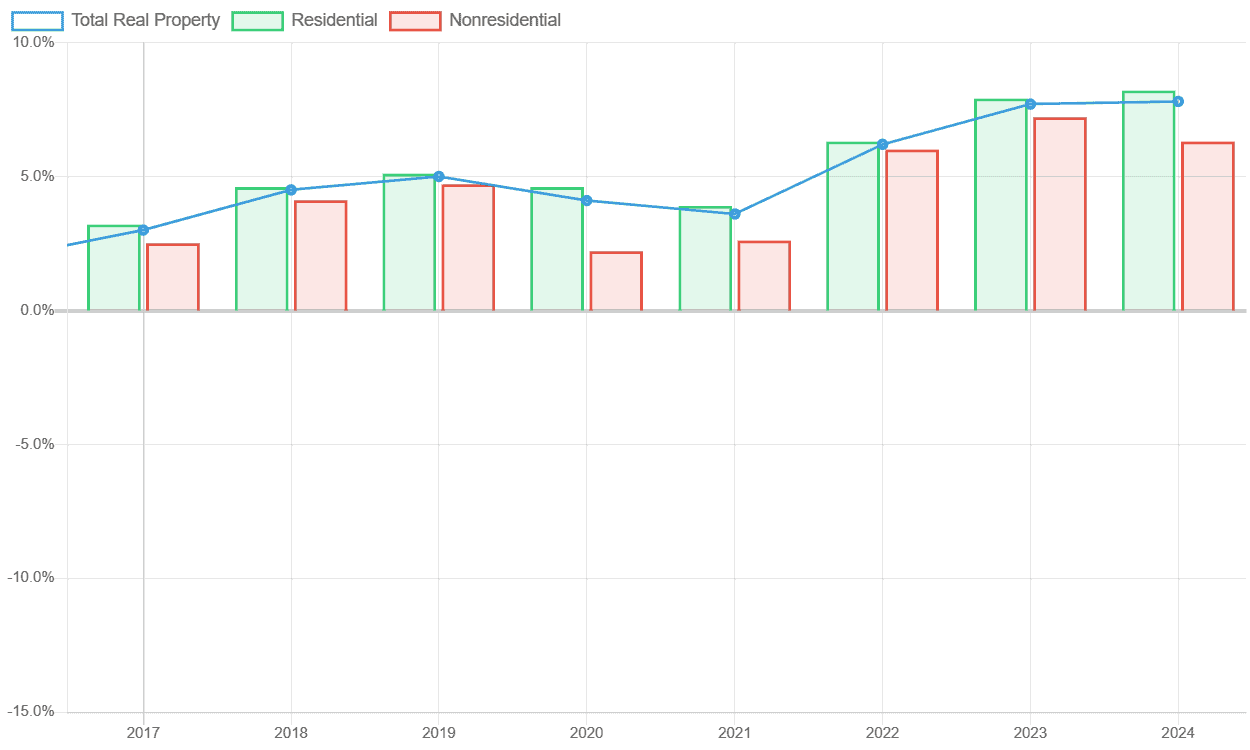

Third, as is well known, interest rates rapidly rose in 2022 and 2023. In order to tame inflation, the Federal Open Market Committee (FOMC) raised the federal funds target rate from just over 0% to over 5.25%. Doing so increased borrowing costs for home builders and home buyers alike. Homes are not only more expensive to build, they are also more expensive to purchase. Mortgage interest rates doubled over the course of 2022, rising from around 3% to more than 6%; where they have remained since (even rising above 7 percent for a few months) (Figure 5). Higher mortgage rates make it costlier for a first-time homebuyer to purchase a house, thus some potential buyers may be choosing to rent rather than own.

Figure 5

Average 30-year Fixed Rate Mortgage

United States

Source: Freddie Mac, 30-Year Fixed Rate Mortgage Average in the United States, retrieved from FRED, Federal Reserve Bank of St. Louis.

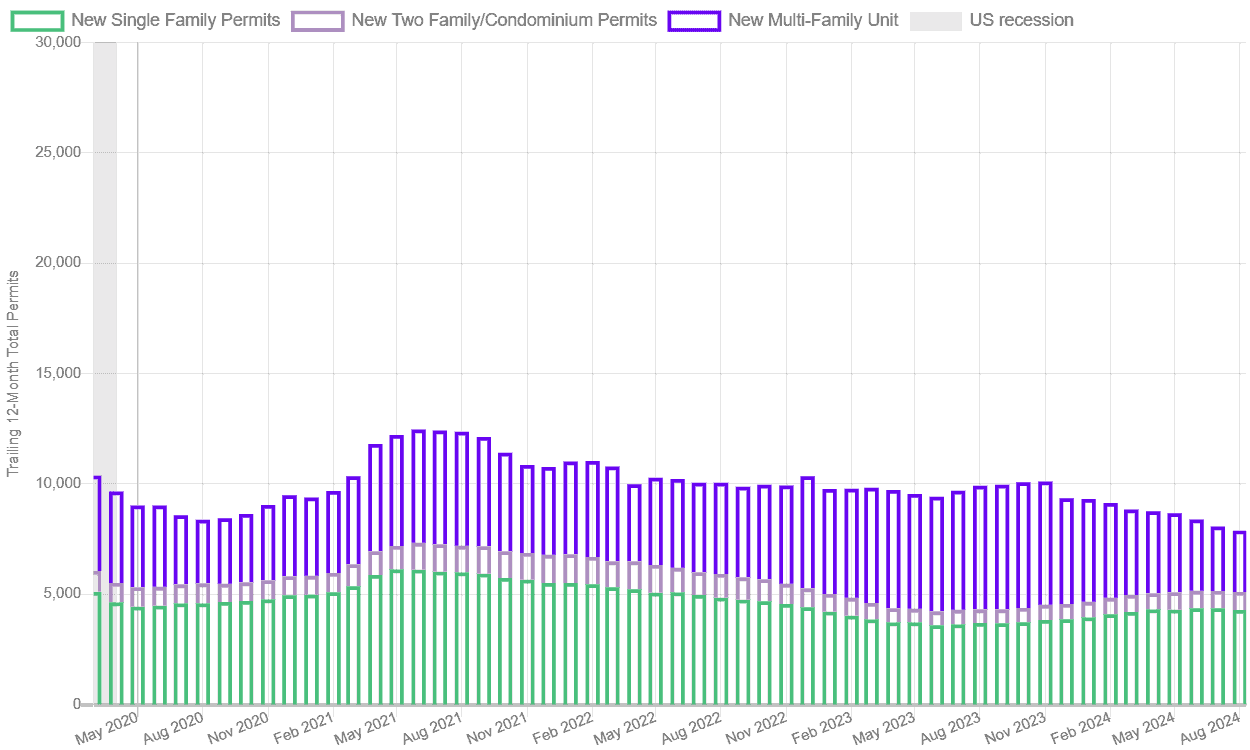

Figure 5 doesn’t show it, but mortgage rates have been below 5 percent since 2010, providing many homeowners the opportunity to refinance. The rapid rise of mortgage rates created a “lock-in” effect, where current homeowners are unwilling to sell their homes and buy new ones with a higher mortgage rate. This keeps many homes off the market, while further increasing prices and removing potential demand for new home construction. CoreLogic estimates about 89% of current mortgages in the U.S. are below 6% (Figure 6).

Figure 6

Source: CoreLogic Blog: Refinance Wave: Nearly $735B in Loans With Rates North of 6.75%, CoreLogic, Inc.

Lastly, some other reasons cited as impediments include outdated regulations and residents protesting new development; however, these tend to be local in nature and it’s difficult to measure their effects.

Moving Forward

So what can local governments do? While most of these challenges are national in scope and it will take time for supply to rebalance with demand, there are efforts locals can undertake to alleviate the impacts of the current shortage:

- Review and update current zoning and building codes; along with streamlining the building permit process. Perhaps there is underutilized commercial property that can be turned into mixed-use, or maybe allow for increased density. Are there any policies that could increase the number of starter homes?

- Educate residents on the importance of new housing. For example, if our region or community wants to attract a 500+ employee firm from another state, there needs to be housing available for the new workers.

- In trying to attract new residents to our region, we can promote our low cost of living. According to the Council for Community Economic Research (C2ER), 6 of our 7 counties have a lower cost of living than the nation (and the 7th county, Oakland, is just above the national average). This is one more promotional piece that makes Southeast Michigan an attractive place to live.

An evolving picture

As we develop policies to encourage housing construction, it is also important to be mindful of how demographics influence supply and demand. Nationally, the Mortgage Bankers Association and Research Institute for Housing America predicted a housing surplus in our country until 2032, largely due to the Baby Boomer generation leaving their homes due to aging or mortality. I don’t think that has happened as yet, as more Boomers are choosing to age in place thanks to the recent inflationary environment and the mortgage rate lock-in effect. However, surplus days could be on the horizon. With Southeast Michigan expected to have 200,000 more people age 65 and older by 2030 (and 281,000 by 2040), housing may come to the market sooner than we think.

Leave a Reply